Why Insurance Policy Changes Matter for Cancer Patients

Insurance policy changes can significantly affect your ability to access timely cancer treatment. Patients without stable insurance often face delays in care, which can worsen health outcomes. For example, disruptions in coverage increase the likelihood of being diagnosed with advanced cancer and reduce access to recommended treatments. Rising costs also create financial strain. Nearly one-third of Medicare beneficiaries delay starting prescribed oral cancer medications due to high out-of-pocket expenses. These challenges highlight why understanding insurance policy changes and their impact on cancer patients is crucial for ensuring better care and outcomes.

Key Takeaways

Knowing your insurance plan helps you avoid surprise bills and get cancer care on time.

Keeping insurance coverage helps treatments work better and lowers the chance of finding cancer late.

Higher costs you pay can cause money problems, making it tough to pay for treatments you need.

Support groups can guide you through insurance issues and help fight denied coverage.

Learning about policy changes helps you push for fair and affordable cancer care.

Key Insurance Terms and Policies Relevant to Cancer Care

Understanding Coverage and Benefits

What is covered under typical cancer care policies?

Cancer care policies often cover a range of treatments and services. These include chemotherapy, radiation therapy, surgery, and prescription medications. Many plans also provide coverage for diagnostic tests, such as imaging and biopsies, which are essential for accurate diagnosis and monitoring. However, the extent of coverage varies by policy. For example, high-deductible health plans (HDHPs) are common among privately insured cancer survivors, especially those with incomes between 200-399% of the Federal Poverty Level (FPL). Nearly 45% of these individuals delay necessary care due to the financial burden. Understanding your policy’s specifics helps you avoid unexpected costs and ensures timely access to care.

The role of pre-authorization and network restrictions

Pre-authorization requirements can delay treatment. Insurers often require approval before covering certain procedures or medications. This process can take days or weeks, which is critical time lost for cancer patients. Network restrictions also play a significant role. If you receive care from an out-of-network provider, your insurance may not cover the costs, leaving you with hefty bills. Staying within your insurer’s network and understanding pre-authorization rules can save you time and money.

Out-of-Pocket Costs and Limits

Deductibles, copayments, and coinsurance explained

Out-of-pocket costs include deductibles, copayments, and coinsurance. A deductible is the amount you pay before your insurance starts covering expenses. Copayments are fixed fees for specific services, like doctor visits or prescriptions. Coinsurance is a percentage of the cost you pay after meeting your deductible. For example, if your coinsurance is 20%, you pay $200 for a $1,000 service. These costs can add up quickly, especially for cancer treatments.

How out-of-pocket maximums protect patients

Out-of-pocket maximums limit the total amount you pay in a year. Once you reach this limit, your insurance covers 100% of eligible expenses. This protection is crucial for cancer patients, as treatment costs can skyrocket. In 2019, adults aged 65 and older with Medicare faced average out-of-pocket costs of $2,200 for medical services in the first year after diagnosis. These costs rose to $3,823 in the end-of-life phase. Knowing your out-of-pocket maximum can help you plan financially and avoid overwhelming expenses.

Continuity of Coverage

The importance of maintaining uninterrupted insurance

Continuous insurance coverage ensures better treatment outcomes. Patients with uninterrupted coverage are more likely to receive recommended treatments and have better survival rates. A study showed that disruptions in coverage increase the likelihood of advanced disease at diagnosis and reduce access to necessary care. Maintaining your insurance helps you avoid these risks and improves your chances of recovery.

Challenges with policy changes during treatment

Policy changes during treatment can create significant challenges. Rising premiums or changes in covered services may force you to switch providers or delay care. For example, patients over 65 with incomes below 200% of the FPL incur average annual out-of-pocket expenses of $2,017, which is higher than those with greater incomes. These financial pressures can disrupt your treatment plan. Staying informed about potential changes helps you prepare and advocate for your needs.

Insurance Policy Changes and Their Impact on Cancer Patients

Financial Implications

Rising premiums and out-of-pocket costs

Insurance policy changes often lead to higher premiums and increased out-of-pocket expenses. From 2009 to 2016, the average total costs for cancer patients rose significantly. Breast cancer costs increased by 29%, while lung cancer costs grew by 11%. High-deductible health plans (HDHPs) further burden patients, leaving many with substantial expenses. For Medicare patients aged 65 and older, annual out-of-pocket costs during the initial phase of care averaged $2,200 for medical services and $243 for prescriptions. These costs climbed to $3,823 and $448, respectively, in the end-of-life phase. Such financial pressures can make it difficult for you to afford necessary treatments, impacting your overall care.

The risk of medical debt for cancer patients

Medical debt is a growing concern for cancer patients. Nearly all patients with cancer-related debt (98%) had insurance when the debt was incurred. About 49% of these individuals carried more than $5,000 in debt, and 67% expected their policies to cover more costs than they did. This financial strain can lead to long-term economic challenges, making it essential to understand your policy and plan for potential expenses.

Access to Treatment

Delays or denials of care due to policy changes

Policy changes can result in delays or denials of care, which directly affect your treatment outcomes. A 2022 survey by the American Society of Clinical Oncology revealed that 42% of prior authorizations for cancer treatments were delayed by more than one business day. These delays caused serious adverse events in 14% of cases. Additionally, disruptions in insurance coverage often lead to late-stage diagnoses and reduced access to recommended treatments. Continuous coverage is critical to ensuring timely care.

Impact on access to specialized cancer treatments

Specialized cancer treatments, such as immunotherapy or targeted therapies, are often expensive and may require pre-authorization. Policy changes can limit your access to these advanced options. For example, delays in starting adjuvant chemotherapy for breast cancer patients have been linked to worse outcomes. Between 2007 and 2017, Medicaid expansion reduced delays in treatment initiation, particularly for racial and ethnic minority groups. This highlights the importance of stable policies in improving access to life-saving treatments.

Health Outcomes

How financial stress affects treatment adherence

Financial stress from rising costs can lead to reduced treatment adherence. A study at Duke Cancer Institute found that 16% of cancer patients reported high financial distress, with 27% indicating medication nonadherence. Some patients skipped doses, took less than prescribed, or avoided filling prescriptions altogether due to cost. These behaviors can compromise your treatment effectiveness and overall health.

Long-term survivorship challenges linked to policy changes

Insurance policy changes can also impact your long-term survivorship. Financial burdens often persist after treatment, affecting your ability to afford follow-up care and monitoring. The economic toll of cancer care in the U.S. exceeded $21 billion in 2019, underscoring the need for stable, comprehensive insurance coverage. Without it, you may face ongoing challenges in managing your health and maintaining a good quality of life.

Real-Life Examples of Policy Impacts

Case Study: A Patient Facing Increased Out-of-Pocket Costs

How a policy change led to financial hardship

Imagine facing a sudden increase in your out-of-pocket costs due to a change in your insurance policy. This scenario is common for many cancer patients. About 71% of patients report financial hardship within a year of starting treatment. Major hardships often include accumulating debt, borrowing money, or experiencing a significant drop in income. The table below highlights the financial challenges patients face:

Evidence Type | Description |

|---|---|

Out-of-pocket costs | Costs as a percentage of income. |

Medical debt | Prevalence of medical debt among patients. |

Financial stress | Psychological impact measured as financial stress, distress, or worry. |

Major financial hardship | Defined as accumulating debt, borrowing money, or significant income decline. |

These financial burdens can disrupt your ability to focus on recovery, adding unnecessary stress to an already challenging journey.

Steps taken to manage the situation

To manage these costs, patients often explore financial assistance programs, negotiate payment plans with providers, or switch to more affordable insurance plans. Some also seek support from nonprofit organizations that specialize in helping cancer patients. Staying informed about your policy and planning for potential changes can help you avoid unexpected financial strain.

Case Study: Denial of Coverage for Experimental Treatments

The impact on a patient's treatment options

Insurance policy changes often limit access to experimental treatments. For example, prior authorizations for cancer therapies frequently cause delays. A 2022 survey by the American Society of Clinical Oncology found that 42% of authorizations were delayed by more than one business day, with 14% resulting in serious adverse events. The table below illustrates the growing challenges:

Study/Survey | Key Findings |

|---|---|

ASCO 2022 Member Survey | 42% of prior authorizations delayed; 14% led to serious adverse events. |

JAMA Network Study | 22% of cancer patients did not receive prescribed care due to denials. |

JAMA Network 2023 Report | Nonspecialty oncology drugs requiring prior approval rose from 16% to 78%. |

These delays can force you to seek alternative treatments or even forgo care altogether.

Advocacy efforts to challenge the denial

Patients often turn to advocacy groups to challenge these denials. Organizations like the Patient Advocate Foundation provide resources to help you appeal insurance decisions. By advocating for yourself or working with these groups, you can improve your chances of accessing the care you need.

Case Study: Health Equity Challenges

Disparities in access to care for underserved communities

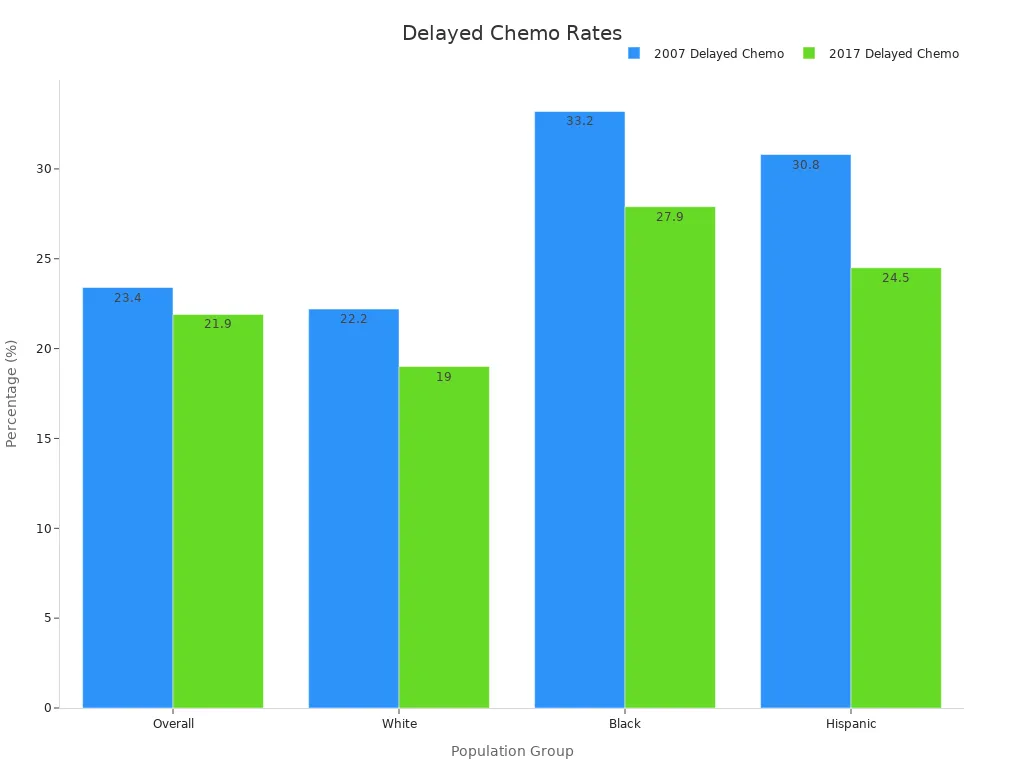

Underserved communities face significant barriers to cancer care. Racial and ethnic minorities experience higher rates of delayed chemotherapy compared to white patients. The chart below shows how these delays have changed over time:

Eliminating these disparities could save $2.3 billion annually in medical costs. However, policy changes often worsen inequities, leaving vulnerable populations with fewer options.

The role of policy in addressing or worsening inequities

Medicaid expansion has shown promise in reducing delays for minority groups. Research from the National Cancer Database reveals that after Medicaid expansion, delays in starting adjuvant chemotherapy decreased, particularly for racial and ethnic minorities. Policies that prioritize equitable access to care can significantly improve outcomes for underserved populations.

Broader Implications of Insurance Policy Changes

Health Equity and Disparities

How policy changes disproportionately affect vulnerable populations

Insurance policy changes often hit vulnerable populations the hardest. For example, uninsured women face more than double the risk of being diagnosed with advanced breast cancer compared to those with private insurance. This lack of coverage also increases their chances of death from the disease. Medicaid expansion has helped reduce these disparities. A study found that patients in expansion states experienced lower mortality rates, especially those with nonmetastatic cancer. Additionally, research shows that Medicaid expansion led to earlier cancer diagnoses and better access to surgical care for lower-income groups. These findings highlight how policy changes can either widen or narrow gaps in health equity.

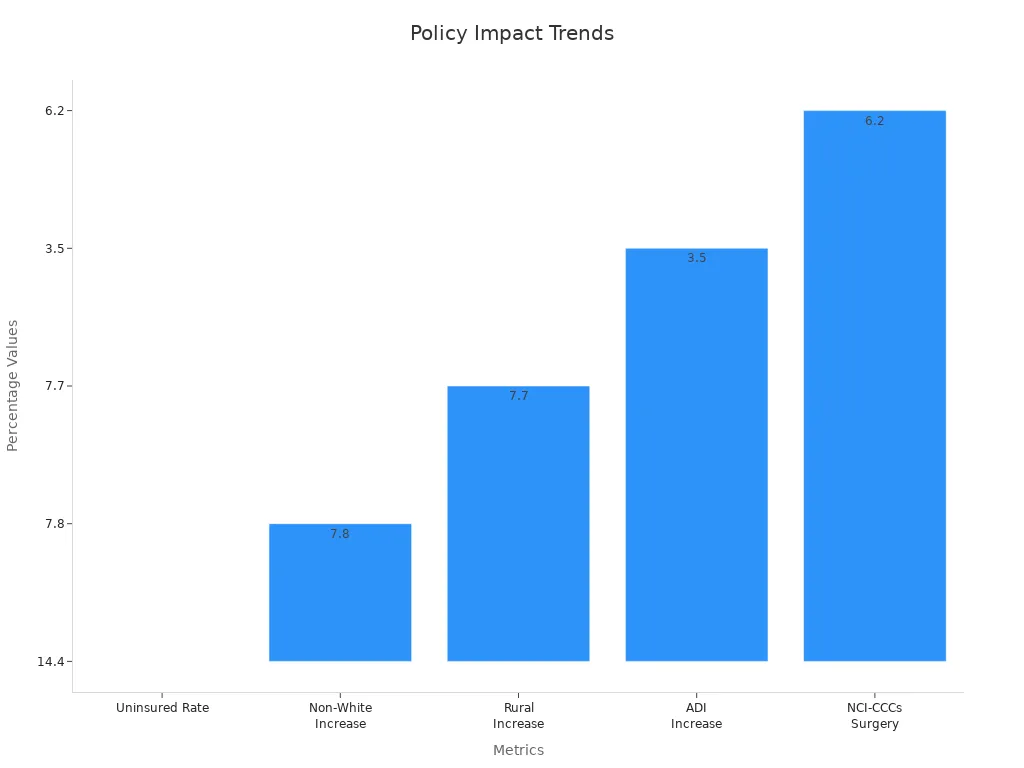

The need for equitable access to cancer care

Equitable access to cancer care is essential for improving outcomes across all communities. Policies like Medicaid expansion have shown promise in reducing delays in treatment and improving survival rates. For example, after Medicaid expansion, rural areas and non-White patients saw a 7.7% and 7.8% increase, respectively, in receiving guideline-concordant care. However, disparities persist, and many underserved populations still struggle to access timely and effective treatments. Addressing these inequities requires policies that prioritize affordability and accessibility for everyone.

Long-Term Survivorship

The financial and emotional toll of policy changes on survivors

Cancer survivors often face long-term financial and emotional challenges due to policy changes. Nearly 75% of survivors worry about affording current or future care costs, with 31% expressing significant financial concerns. Survivors with public insurance, such as Medicaid or Medicare, are nearly twice as likely to experience financial hardship compared to those with private insurance. These hardships can lead to ongoing stress, making it harder for survivors to focus on recovery and maintain their quality of life.

Statistic | Description |

|---|---|

1.95 | Patients with public insurance (Medicaid or Medicare) have an increased risk of financial hardship compared to those with private insurance (OR, 1.95; P < .0001). |

75% | Nearly three-quarters of cancer survivors are concerned about their ability to pay current or future costs of their cancer care. |

31% | 31% of cancer survivors are very concerned about their financial situation regarding cancer care costs. |

The importance of stable, comprehensive coverage for survivorship care

Stable insurance coverage plays a critical role in survivorship care. Survivors often require ongoing monitoring, follow-up treatments, and support for long-term side effects. Without comprehensive coverage, these essential services become unaffordable for many. Policies that ensure consistent and affordable coverage can help survivors manage their health and reduce the emotional toll of financial uncertainty.

Advocacy and Policy Reform

The role of patient advocacy in shaping better policies

Patient advocacy is a powerful tool for driving policy reform. Advocacy groups work to amplify your voice, ensuring policymakers understand the real-world impact of insurance changes. These organizations also provide resources to help you navigate complex insurance systems and appeal coverage denials. By joining advocacy efforts, you can contribute to creating policies that prioritize patient needs.

Steps policymakers can take to improve cancer care access

Policymakers can take several steps to improve access to cancer care. Expanding Medicaid in all states would reduce disparities and improve outcomes for underserved populations. Implementing caps on out-of-pocket costs can protect patients from financial ruin. Additionally, simplifying pre-authorization processes can prevent delays in treatment. These changes would create a more equitable and efficient healthcare system, ensuring that all cancer patients receive the care they need.

Insurance policy changes directly affect your access to cancer care, financial stability, and overall health outcomes. Staying informed helps you prepare for these changes and avoid unexpected challenges. Advocacy efforts play a vital role in shaping policies that prioritize patient needs.

Delays in starting chemotherapy for breast cancer patients dropped from 23.4% to 21.9%.

Medicaid expansion reduced racial disparities in timely treatment, narrowing the gap between Black and white patients from 4.8 to 0.8 percentage points.

Patients with public insurance face nearly double the financial hardship compared to those with private plans.

By staying proactive, you can navigate these challenges and advocate for equitable, affordable care.

FAQ

What should you do if your insurance denies coverage for a treatment?

File an appeal with your insurance provider.

Request a detailed explanation for the denial.

Seek help from patient advocacy groups.

Tip: Organizations like the Patient Advocate Foundation can guide you through the appeals process. 🛠️

How can you reduce out-of-pocket costs for cancer care?

Check if your provider offers financial assistance programs.

Use generic medications when possible.

Explore nonprofit organizations that help with medical bills.

Note: Always review your policy to understand your deductible and out-of-pocket maximum. 💡

Can you switch insurance plans during cancer treatment?

Yes, but it may disrupt your care. Ensure the new plan covers your current providers and treatments. Consult with your healthcare team before making changes.

Warning: Switching plans might lead to delays in treatment due to pre-authorization requirements. ⚠️

What is the best way to stay informed about policy changes?

Regularly review your insurance policy updates.

Subscribe to newsletters from cancer advocacy groups.

Attend informational webinars or workshops.

Tip: Staying proactive helps you avoid surprises and plan effectively. 📚

Are experimental treatments covered by insurance?

Most insurance plans do not cover experimental treatments. However, some policies may include clinical trials. Check with your insurer and discuss options with your doctor.

Reminder: Advocacy groups can help you challenge coverage denials for experimental therapies. 🩺

See Also

Exploring Anal Cancer: Symptoms And Underlying Causes

Key Insights About Carcinoid Tumors You Need To Know

Recognizing Symptoms And Treatments For Duodenal Cancer

Essential Information Regarding Symptoms Of Adrenocortical Carcinoma